[us_single_image image=”1189″ size=”medium”]

[vc_empty_space height=”10px”]

[vc_empty_space height=”10px”]

My life is so full and busy that it’s hard to sum up in a paragraph or two for a bio introduction on a website. Obviously, you already know that I’m a financial advisor but that is just one small piece of me. I’ve been married to my husband since 1996 and have 5, sometimes 6 children. If that leaves you scratching your head, it’s because we opened our doors to children that needed a family to love them in 2014. We have two biological children, have adopted 3 children, and then have what we call a “bonus child” that spends a lot of time with us.

My husband, Shane, divides his time between serving as an associate pastor at our church, chaplain for the hospital, and a dean of a small Christian college in our town. Oh, and he helps tag team for me with the kids.

I graduated from Ouachita Baptist University in 1999 with a degree in professional accountancy. I worked both public and private accounting for about 7 years untill I really felt a pull away from it. Feeling a need to minister to kids, I thought teaching may be the direction to go and tried my hand at substitute teaching. Hind sight, I’m glad the Lord shut that door and soon after opened the door to financial advising. I got my securities licenses in 2007 and have worked with the StrongTower team ever since.

I can say that helping people with their finances and helping them set and meet their goals is something I truly enjoy. I also work with the best people I could imagine. Thankfully I think they like me too because I’m not going anywhere! Good people with integrity, character, and values are hard to come by and work side by side with. Because of that, I foresee many more years of, not only working in the financial services industry, but also working with the StrongTower team.

21 Comments.

Well stated. Thank you Todd.

Thanks, Mike!

Thank you for you reassuranceTodd! Looking at the overall picture makes me feel better. I know God is in control!!

We really appreciate you Todd. I am constantly reminded that God promises to do His part. We have to do our part. Our part is to be obedient and good stewards. Thank you for being a stewardship partner and friend for many years!

Thanks, Sal. We’ve both grown in our stewardship journeys over the past several years. Great having you as a partner as well!

Thank you, Todd!

You’re very welcome, “Pit Bull”! ?

Thanks for the update and the level-headed perspective, Todd! May God continue to bless you & your family & this company, and we can trust that God is in control of whatever happens.

Thanks so much, Colleen! Hope you guys are well in Massachusetts!

Thanks so much, Todd.

Totally agree with everything you said! Thanks!!

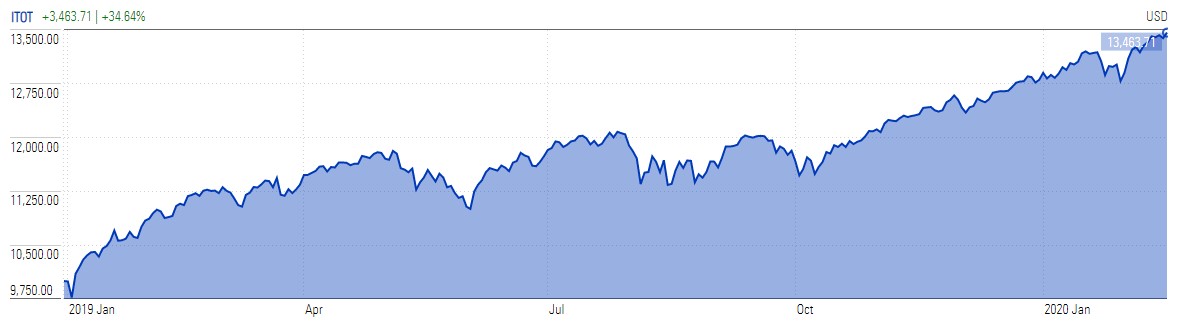

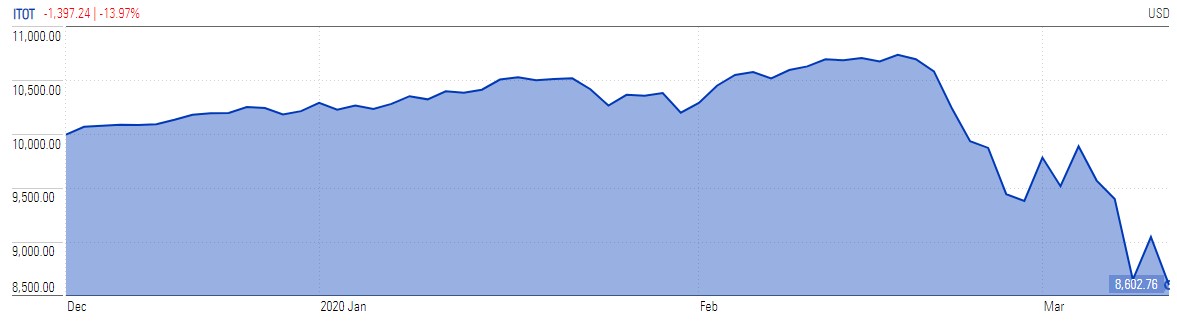

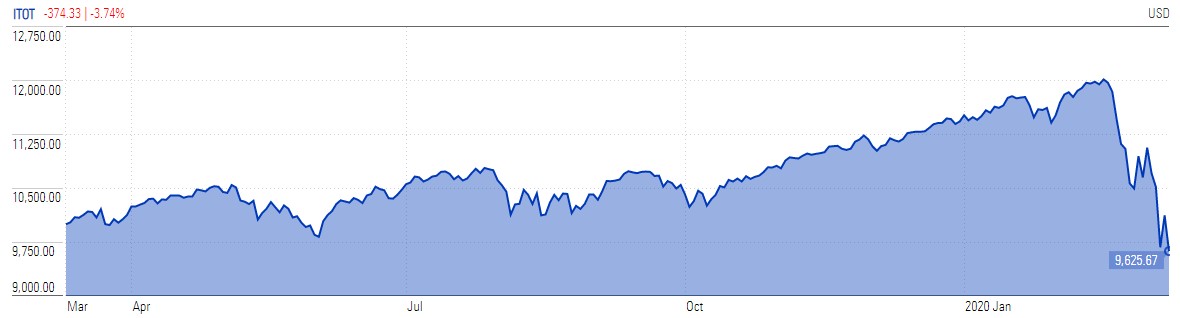

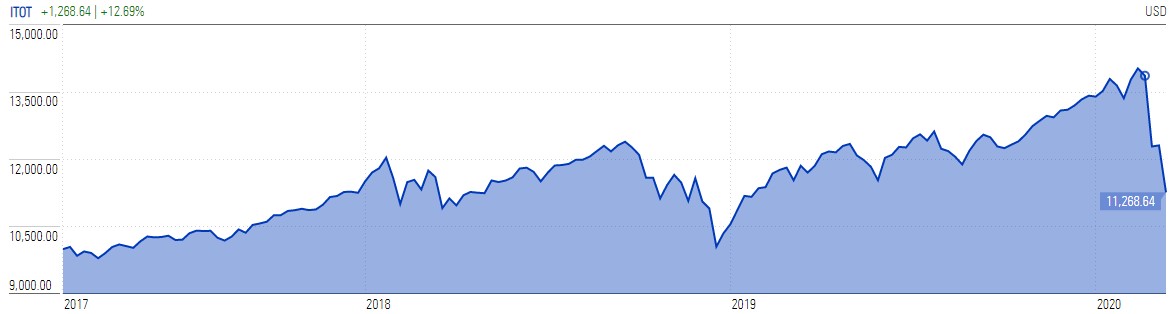

We appreciate your well written summary and graphs.

Thank you,

You know how much I love my nerdy graphs! LOL

Thank you Todd. Our trust in God and the promise in Phil 4:19 keeps us at peace. And we trust you and Strongtower to make wise decisions. Praying for you and all who work with you.

Thank you for communicating with us about what is happening, it’s comforting and helps us understand.

Thank you Todd for reiterating what we as believers know to do, have faith and do not waiver for the Lord is on our side. Thank you for keeping watch for us and helping us be good stewards of what the Lord has given us.

Thank you for the update–I appreciate your words and graphs of encouragement. We love Strongtower’s Godly perspective! Prayers for continued wise discernment as you steward His resources for us! 1 Chronicles 29:11-12

Thanks for the prayers, Starr! Great scripture reference. Maintaining an eternal perspective is SO helpful in times of fear.

Finally a sane and calm response! Thank You!

We are at peace. We pray for you and your family daily as well as the entire staff. Thank you for keeping us in the know about the current events. Our faith in God keeps us grounded and praying without ceasing. The angels encamp around all of us as God’s children.

Thanks so much for the prayers!